Get Ready for Tax Season by Estimating Your Tax Refund

by Susannah McQuitty

You got this—all you have to do is start!

We make filing taxes delightfully simple with one, flat–rate price. Every feature included for everyone.

Start filing

But tax filing season is so far away and I don’t even have my W-2 yet; why would I need to estimate my taxes before January?

Well, if you end up owing additional taxes for the year, wouldn’t you rather find out sooner than later? Or, if you end up with a refund, wouldn’t you like to know how much you may be getting? Christmas is coming up, after all, and you probably want to know just how much you can spend.

Estimating your taxes on 1040.com

Estimating your taxes with 1040.com’s Tax Calculator is simple (and free), and you can do it in just a few minutes. You’ll provide some information about yourself and your household, your estimated income for the tax year, and any expenses that qualify you for tax breaks.

Let’s take those one at a time.

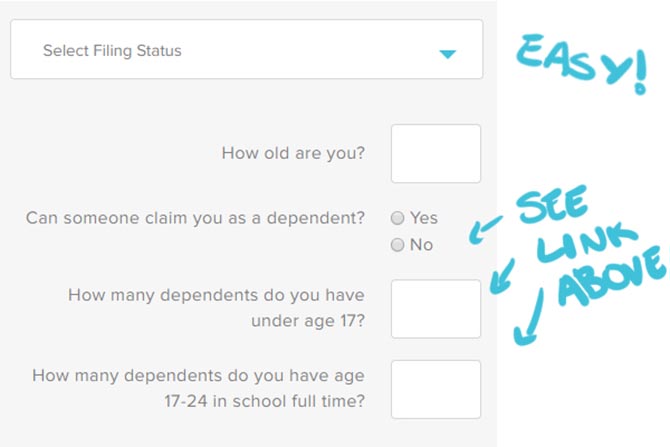

1. Taxpayer information

Enter basic information about yourself (like age and filing status) and any dependents (if applicable). Check out our Tax Guide page on dependents for more information on who is classified as a dependent.

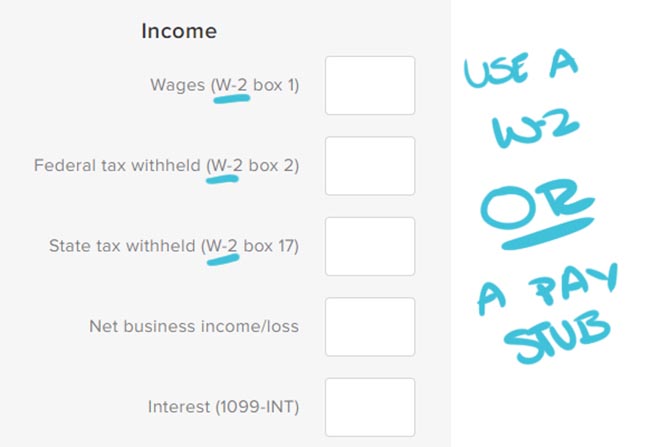

2. Income information

Next, provide your income information. These boxes can be filled with info from tax documents (like a W-2 or 1099-INT) or yearly estimations from pay stubs, invoices, and other income documentation. Remember: While you can use pay stubs to estimate your taxes, you should only use an official W-2 to file your return.

Not every taxpayer will use every box on this screen, so as soon as you enter amounts in the fields that apply to you, move along to the next step.

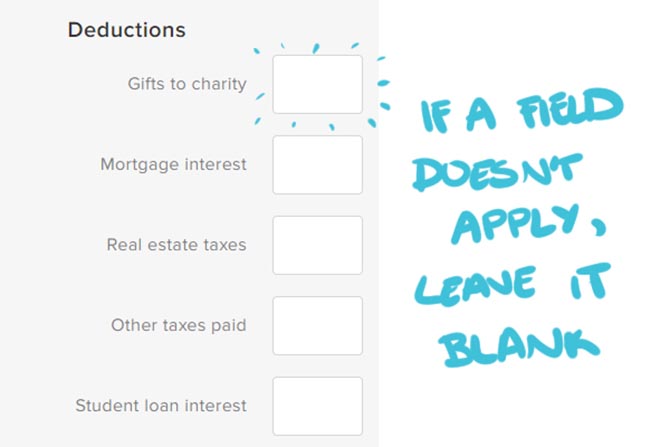

3. Deduction information

Deductible expenses, like charitable contributions and student loan interest, will reduce your taxable income, so you definitely want to complete each field that applies to you.

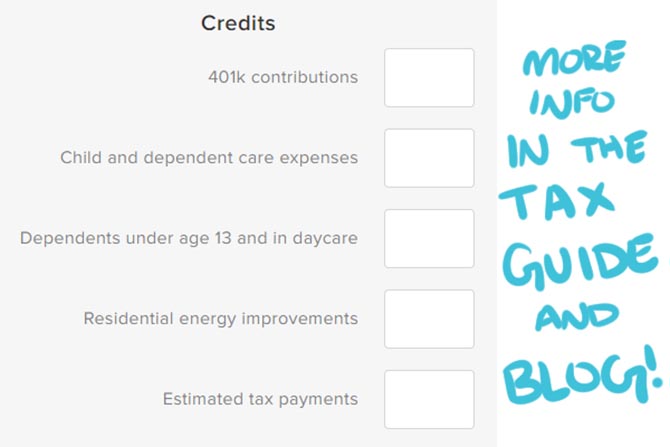

4. Credit information

The last step is where you’ll enter credits and payments. Credits directly reduce any tax owed, so this is where the best tax breaks live. Most are pretty self-explanatory, but check out our blog for more info (if, for example, you’re not sure what estimated tax payments are).

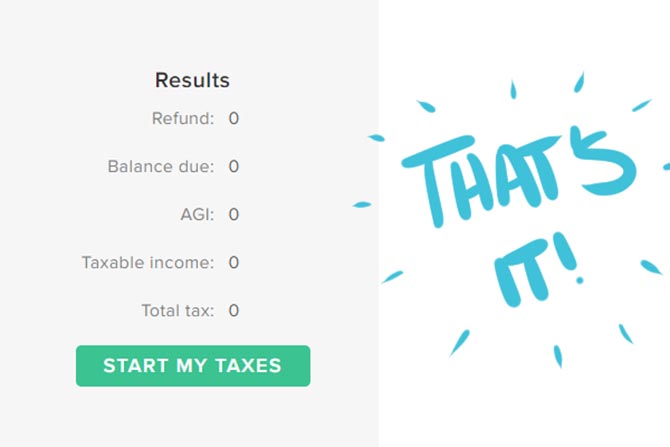

5. Results

Boom—you now have an estimate of your tax liability, adjusted gross income (AGI), and your refund, all in one place.

It’s important to note that this is just an estimate of your tax situation (especially if you are relying on pay stubs), but it’s a great way to get a bird’s eye view of your taxes before you actually file your return.

You can use the 1040.com tax estimator on our website or download it from the App Store or Google Play.

Sign up for more of this.

Subscribe to our blog for year–round finance strategies and tax tips. We’re here to remove the dread from filing taxes.